My Take: Mobile Banking eBook From Ernst & Young and Knowledge@Wharton

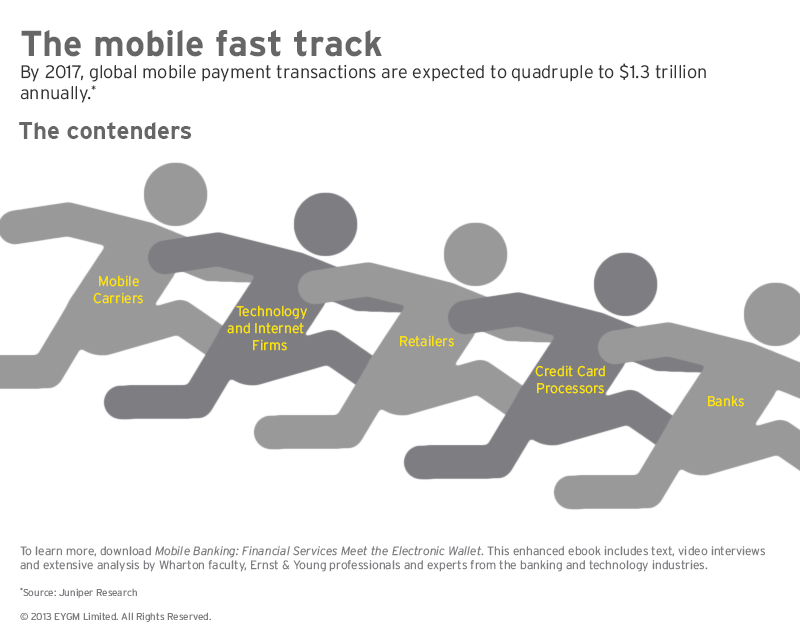

An interesting eBook was recently published by Ernst & Young in partnership with Knowledge@Wharton titled “Mobile Banking: Financial Services Meet the Electronic Wallet.” You can read a summary, watch a short video and download it for free.

The book provides a good overview of the opportunity for mobile money. The market has definitely reach a tipping point; Based on our experience in late 2011 we felt the direction was clear from the number of installations, and requests we have received from the market. I would have liked to see a clearer definition for Mobile Money defined once and for all, as I do believe many people cannot differentiate the nuances of Mobile Money into their respective categories.

My definitions differentiate the category of platforms, markets, and users have come from how we, Telepin, characterize our deployments with our customers: ·

- Mobile Banking: A platform that provides a window into a banking platform.

- Mobile Payments & Commerce: A platform that orchestrates the payment processing from mobile phone to a payment product.

- Mobile Remittance: A platform that interconnects several Mobile Money Platforms

- Mobile Money: A complete platform that holds a stored value for a consumer/merchant and provides the services of Mobile Banking, Payments & Commerce as well. Fundamental difference is the existence of a mobile wallet, whereas the previous platforms do not require and at time do not have a stored value accounts (mobile wallet).

In 1999, I worked on a mobile banking product with Microcell and Royal Bank of Canada; commercially launched as Fido Pro. Fido Pro provided accessibility for those on Microcell 2G GSM network using what was the best handsets at the time; Nokia 52xx or 62xx series devices. Full encryption from SIM Card to server. Fido Pro competed with web based banking via broadband; providing a subset of the most popular banking services anytime, and anywhere. The product had a great launch, but a short commercial shelf life. Fido Pro was Mobile Banking.

The market advanced further in their thinking in 2003 with an attempt to create standardization for Mobile Payments via SimPay http://en.wikipedia.org/wiki/Simpay. SimPay disbanded in 2005. PayForItUK lives on from that experience.

According to EY 10 such mobile payment systems existed worldwide in 2006. How many readers remember NTT Docomo i-Mode? I-Mode was exported into 17 markets with difficulty; and led me to believe what is created in Japan stays in Japan as the market dynamics are very culturally different producing differing success factors. In Mobile Money was it the 11th platform that moved the market from skeptics to believers? The market was fortunate enough with the success of M-Pesa in Kenya and with many markets with similar characteristics. The World Bank, USAID, Grameen Foundation, CGAP, and foundations like the Bill and Melinda Gates foundation brought this market the attention it needed and deserved.

In 2008, Telepin morphed into a Mobile Money platform company partly from market pull but purposely because the market need finally existed. As I stated earlier in the definition of the market segments of Mobile Money in one market we have all platforms servicing Mobile Banking Customers, providing mobile payments & commerce, processing mobile remittance transactions, and a Mobile Money account holding millions of dollars in individual stored value accounts.

There’s a few areas where I disagree with Ernst & Young’s views including:

The bank-led model doesn’t work in my opinion to service the bottom of the pyramid. Banks of a fundamental cooperative role to play with a Telco, but a bank led model with the intention of fulfilling the needs of the unbanked will not work. Many failed examples exist.

Google and the emerging market: counter to the author my view is Google is not interested in the developing market. Google is an advertising company whereby the interest lies in well-developed ecosystems and overlaying an advertising and marketing platform on a well developed market. Paypal developing a relationship with the unbanked: for same reasons as why banks are not developing relationships with the unbanked; the cost to maintain low-value customer is greater than the value brought by the previously unbanked customer. Square is shaking up the payment processing market; but none existent in anything else related outside of credit cards and square payment processing dongles.

Location-based examples “so when you walk into your favorite coffee shop your loyalty card appears and you can scan it to buy a coffee or check your balance”. This particular example has been played over and over; remember Signalsoft? Remember Openwave? I do, maybe I’m the problem, but to date I search for the coupons. A coupon has yet to seek me out.

“Banks need to move on mobile money”. I agree banks need to provide access via the Web and via Mobile. However, to reach the unbanked banks need to move fast and seek out a Mobile Network operator partner. To determine if your market should be bank led or operator led, simply calculate the ratio of Mobile Network Operators to Banks. If the ratio is near to equal then both banks and mobile operators have the same opportunity. In most markets the ratio of banks to operators are around 50:1; Mobile Operators rule.

I highly recommend reading Ernst & Young “Mobile Banking: Financial Services Meet the Electronic Wallet.” You can check out the mention Telepin client Digicel in the report as well. Thanks to the report authors for including them as they are a solid example of innovation in mobile money.

I live and breathe Mobile Money every day and this ebook does a fair job of illustrating the market challenges and potential. Mobile Money as it exists today will be very different in five years and I can’t wait to see where it takes us.

Powered By Telepin: Tunisie Telecom Revolutionizes Its Charging System - Read More

Powered By Telepin: Tunisie Telecom Revolutionizes Its Charging System - Read More